FY Financial Announces GEM Board Listing Plan

To Raise Up to RMB144.5 million

Offer Price Ranges between HK$1.31 and HK$1.87 Per Share

(9 May 2017, Hong Kong) FY Financial (Shenzhen) Co., Ltd ("FY Financial" or "the Company", together with its subsidiary "the Group"), the Shenzhen-based financial services company that provides equipment-based financial leasing andcommercial factoring to corporations on the mainland, today announces details of its listing plan on the Growth Enterprise Market ("GEM") of the Stock Exchange of Hong Kong Limited.

FY Financial plans to offer 89,840,000 H shares (subject to offer size adjustment option), respresenting 25% of the enlarged number of shares in issue following completion of listing (assuming the offer share adjustment option is not exercised).90% of the shares will be offered by way of placing, and the remaining 10% will be public offer shares (subject to reallocation). The indicativeoffer price range is set between HK$1.31 and HK$1.87 per share. The shares will be traded in board lots of 2,000each. FY Financial will raise up to RMB$144.5 million. Dongxing Securities (Hong Kong) is the sole sponsor, sole bookrunner, and sole lead manager of this share offer.

The Hong Kong public offer will open at 9:00 a.m. on 10 May 2017 and close at 12:00 noon on 15 May 2017. The expected price determination date will be on 15 May 2017, and dealing of the shares is expected to commence on 23 May 2017 under the stock code 8452.

A Forerunner in Commercial Factoring and Leasing

FY Financial is among the first batch of companies to engage in commercial factoring business in the PRC in 2013 pursuant to the Circular of the Ministry of Commerce ("MOFCOM") on Issues Related to the Pilot Program of Commercial Factoring promulgated by MOFCOM. It focuses on providing equipment-based finance leasing, commercial factoring and advisory services to corporations in the

PRC. The Company provides customised finance leasing services based on the industry of, and equipment required by, customers, and its finance lease offering comprises direct finance lease, new sale-leaseback and used sale-leaseback transactions.

Mr. Zhuang Wei, FY Financial Chairman and Non-executive Director, said, "The China commercial factoring and leasing market offers lucative opportunities. Following the transition of China’s economic structure, corporations in mainland China are expected to upgrade their manufacturing process by purchasing necessary equipment and tools. The risinig demandfor equipment and tools is likely to fuel the industry development. As one of the first companies to engage in commercial factoring and leasing, FY Financial is posied to take advantage of our position as a forerunner to capture market opportunities, to expand the scale of our business and increase our market share."

Strong Support from A-share Listed Parent Shanshan Group

Since the commencement of its finance leasing business in 2013, with the support, insight, reputation and wide-ranging industry connections from its controlling shareholderShanshan Group (stock code: 600884), an A-share company listed on the Shanghai Stock Exchange, theCompany has focused its efforts on providing finance leasing services to the FMCG, electronics, medical, alternative energy and transportation industries across the PRC, where the company has established connections with industry players andaccumulated valuable expertise. At present,FY Financial has an extensive customebr base of over 240 finance leasing customers in various industries in more than 25 different municipalities, provinces and autonomous regions in the PRC.

Efficient Risk Management Regime Results in No Non-Performing Assets in 2015 and 2016

The Company has put in place an efficient risk management system to identify and minimise risk, with a focus on managing the risks through comprehensive due diligence on the customer, independent information review and multi-level approval process. All finance leasing and factoring transactions are reviewed by the corresponding risk management department and risk assessment committee prior to signing of transaction documents. As a result of the Company's stringent and mature risk management procedures, there is no non-performing assets for all finance leases entered into during the years ended 31 December 2015 and 2016. The Company will continue to focus on the finance leasing and factoring business of a number of strategic industries, and to monitor and assess the operation and performance of the risk management system, to enhance the company's risk management capabilities.

According to the CIC Report, the PRC finance leasing market is expected to experience substantial growth. The outstanding balance is expected to grow from RMB5.3 trillion in 2016 to RMB13.3 trillion in 2021 at a CAGR of 20%, while new contract volume is expected to reach RMB9.6 trillion in 2021 with a CAGR of 20.1%. Penetration rate will increase from 6.3% in 2016 to 11.2% in 2021. The PRC commercial factoring market is expected to grow from RMB500 billion in 2016 to RMB4,607 billion in 2021. The penetration rate of commercial factoring as a percentage of total factoring turnover is expected to increase from 17.9% in 2016 to 65.8% in 2021.

Going forward, the Company intends to further develop its finance leasing business by targeting the medical and alternative energy industries, whichis expected to offer stable income streams, strong and apparent government support and less susceptibility to cyclical market fluctuations.

Chairman Zhuang concluded, "Looking ahead, we will actively expand our finance leasing business and integrate our business connections with upstream and downstream resources in emerging industries such as the medical, alternative energy and transportation industries and increase the economic benefits we can derive from our operations.Meanwhile, we will develop the finance leasing business in traditional industries such as the electronics and FMCG industries and also focus and intensify our efforts in developing in the emerging industries. Through enhancing our specialised and professional workforce, and our risk management capabilities, we will expand and optimise the size and structure of our finance leasing and factoring buiness portfolio, and further increase our competitive strengths. Our vision is to become the leading financial services provider in the PRC."

FY Financial (Shenzhen) Co., Ltd

Offering Summary

Number of Offer Shares | : | 89,840,000 H Shares (subject to offer size adjustment option) |

Number of Public Offer Shares | : | 8,984,000 H Shares (subject to reallocation) |

Number of Placing Shares | : | 80,856,000 H Shares (subject to reallocation and the offer size adjustment option) |

Indicative Offer Price Range | : | HK$1.31 - HK$1.87 per H Share |

Board Lot Size | : | 2,000 Shares |

Hong Kong Public Offer Period | : | 9:00 a.m., 10 May 2017 (Wed) to 12:00 noon, 15 May 2017 (Mon) |

Expected Price Determination Date Announcement of Allotment Results | : | 15 May 2017 (Mon) 22 May 2017 (Mon) |

Debut Trading of Shares | : | 23 May 2017 (Tue) |

Stock Code | : | 8452 |

Use of Proceeds:

After deduction of the estimated underwriting fees and other related expenses and assuming an offer price of HK$1.59 per share, being the mid-point of the indicative offer price range, the net proceeds from the Share Offer are estimated to beapproximately RMB101.0 million, or RMB119.5 million upon the exercise of the offer size adjustment option in full.

The Company intends to use the net proceeds from the Share Offer for the following purposes:

Purpose | Net Proceed (RMB million) | Percentage of Net Proceed |

· Expand finance leasing operations · Expand factoring operations · Working capital and other general corporate purposes | 75.8 20.2 5.0 | 75% 20% 5% |

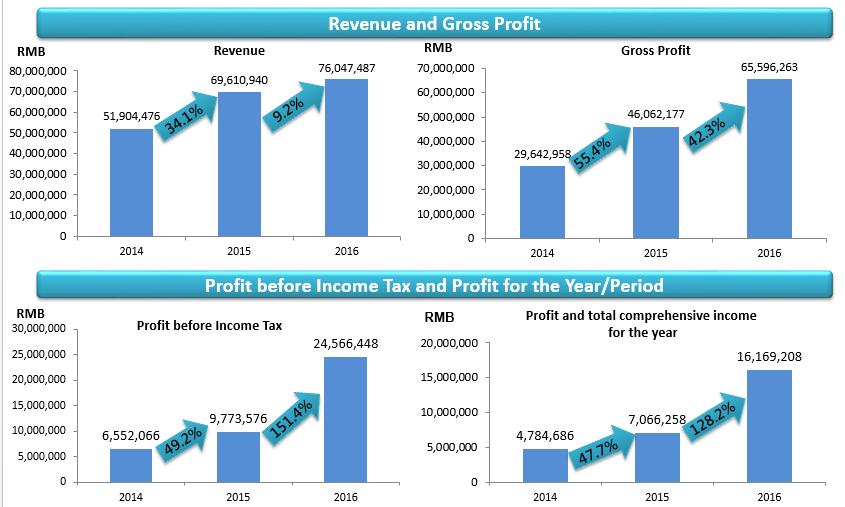

Financial Highlights: