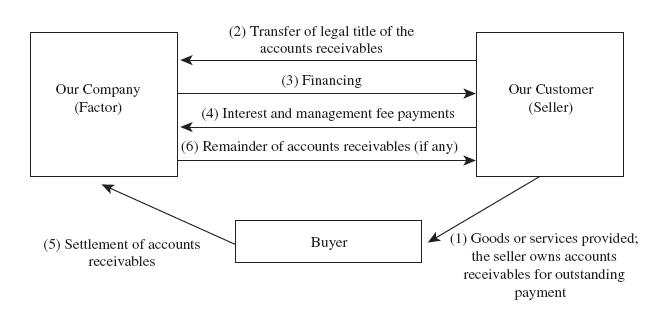

A typical factoring transaction involves three parties: we (as factor) provide financing and accounts receivable management services to our customer (as seller) in return for (i) interest and management fee income payments and (ii) transfer of legal title of accounts receivable from our customer to us.

1. After the transfer of the accounts receivable to us, we own the right to receive the outstanding amount of the accounts receivable from the buyer.

2. We provide our customers with net financing which generally do not exceed 80% of the net value of the accounts receivable under the factoring agreement.

3. Such accounts receivable are usually payable within one year.

4. When the buyer (i.e. debtor of the accounts receivable) settles the accounts receivable, such sums are first applied to the settlement of the financing provided to our customer under the factoring transaction between our customer and us, and any remainder are then paid to our customer.

The following diagram illustrates the relationship among the three parties: