Direct finance leasing is mainly used when our customers commence new projects, expand production, upgrade their technology and have financial demands to purchase new equipment. We fund our direct finance leases primarily through our own capital, bank borrowings and shareholders’ loan.

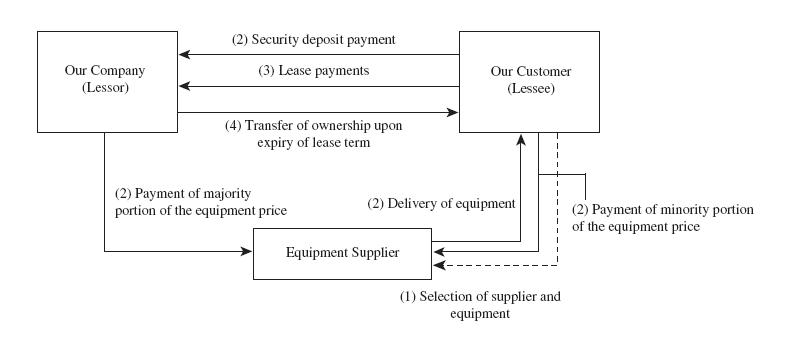

1. We (as lessor) will purchase specific asset under the lease agreement from the equipment supplier, pursuant to the instructions given by the lessee.

2. We pay 60% to 90% of the purchase price of the asset and the lessee pays the remainder of the purchase price directly to the equipment supplier.

3. The lessee also pays us a security deposit at the time of the purchase, which typically ranges from 5% to 20% of the purchase price. In some cases, the equipment supplier also pays us a security deposit at the time of the purchase, which typically ranges from 10% to 20% of the purchase price.

4. We then lease the asset to our customer (as lessee) for its use in return for periodic lease payments paid by the customer to us.

5. Usually in two to three years, or in some cases on longer terms, the lessee repays the portion of purchase amount of the assets provided by us, together with interest and other fees to us

6. At the end of the lease term, the ownership of the assets will be transferred to the lessee.

The following diagram illustrates the relationship among the three parties: