Used sale-leaseback is primarily used by our customers who need working capital for their operations. We fund our used sale-leaseback transactions primarily through our own capital, bank borrowings and shareholders’ loans.

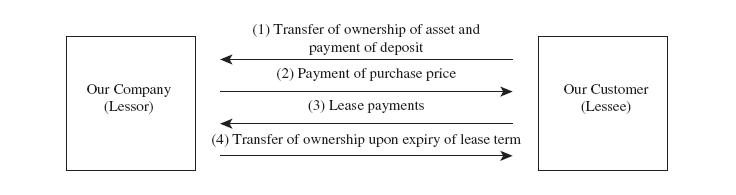

1. The customer (the lessee) sells their existing asset to our Company (the lessor) at a negotiated purchase price with reference to an appraised value by specialists from our Business and Risk Management Departments, and approved by our Project Approval Committee or our Risk Investment Committee. The negotiated purchase price is typically 50% to 75% of the agreed value of the equipment.

2. We then lease the asset back to the lessee for its use in return for periodic lease payments paid by the customer to us.

3. The lessee also pays us a security deposit at the time of the purchase, which typically ranges from 10% to 15% of the negotiated purchase price.

4. Usually in three years, the lessee repays the purchase amount of the asset, interests and other fees to the lessor.

5. At the end of the lease term, the ownership of the assets will be transferred to the lessee.

The following diagram illustrates the relationship between the two parties: